February 2023 — March 2024

Unified three platforms into one onboarding experience for 40,000+ business clients

A one-time acquisition onboarding that has been shaped by service design and regulatory constraints

As part of RBC’s $13.5B acquisition, 40,000 business clients needed to onboard onto RBC’s business banking ecosystem before their accounts are transferred.

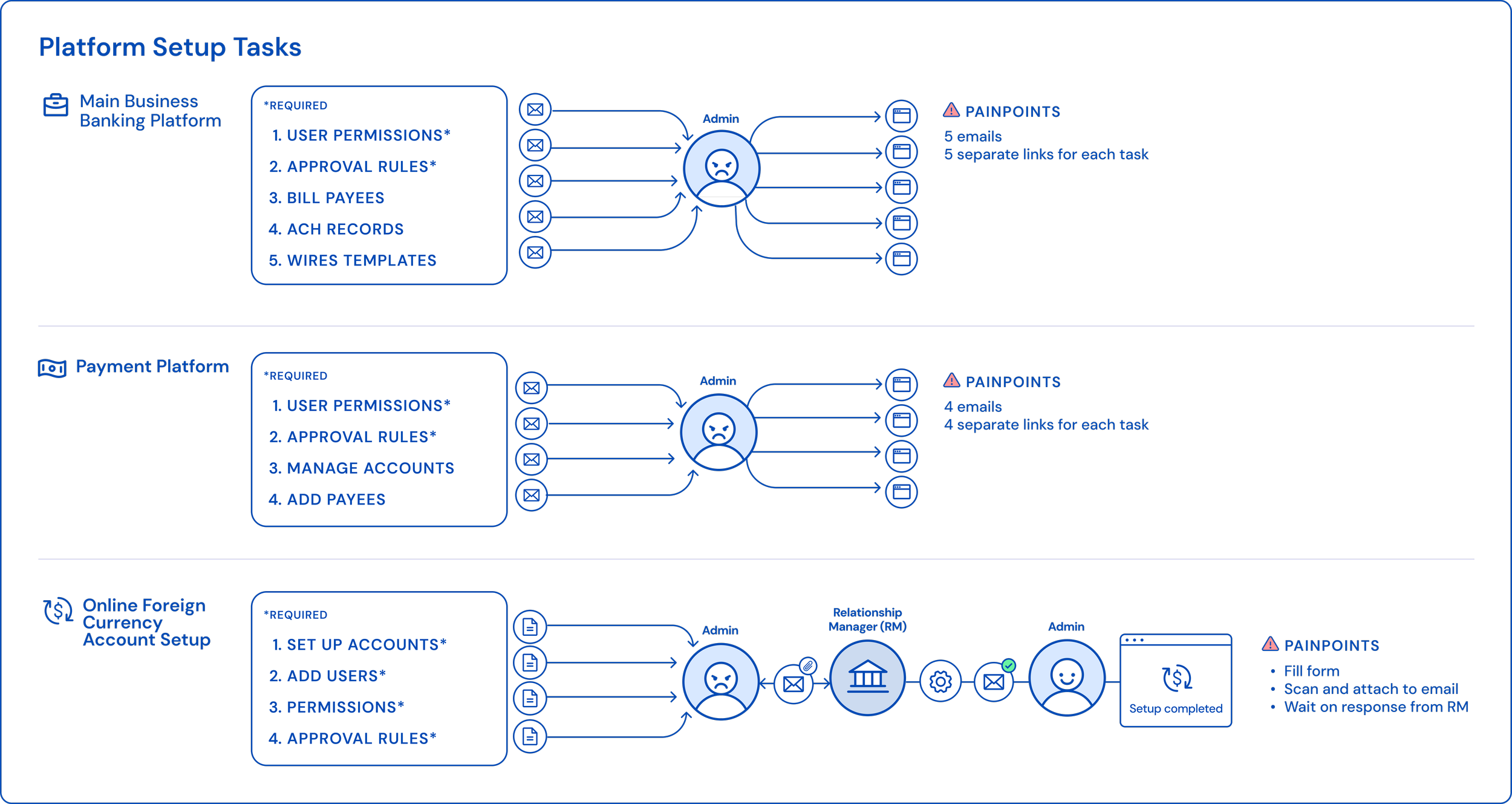

However, critical setup tasks were fragmented across three legacy platforms: two unintuitive systems rely on emails to complete tasks with no walkthroughs or guides and one system require manual setup that took up to a week to complete. This complexity forced heavy reliance on customer support and put clients’ ability to bank immediately at risk.

CONSTRAINTS

The onboarding experience had to be designed before the acquisition was approved, limiting timelines and flexibility

Regulatory restrictions prevented any direct client research

Legacy systems could not be modified due to fragile code and risk to existing clients

MY R E S P O N S I B I L I T I E S

Service design

Workflows

High-fidelity prototypes

Design & Accessibility QA

Freed Support to Focus on High-Value Clients

Guided self-serve flow cut routine calls and freed support for high-value migrations.

Freed Relationship Managers from Manual Setup

Digital setup reduced RM configuration work, freeing time to build new client relationships.

Greater Confidence to Complete Complex Setup

Progressive disclosure in complex tasks reduced confusion and enabled self-serving setup and plan operations without disruption.

P R O J E C T O U T C O M E S

To comply with Non-Disclosure Agreements, proprietary product details in this portfolio have been anonymized and metrics have been generalized. This ensures the protection of confidential information.

Mapping Client Journey

Since we didn't have much data, I co-facilitated workshops with design lead to draft and walk through the jounrey with business ops, relationship managers, technical leads, and banking directors.

First draft: mapping the current onboarding process. (Feel free to enlarge the journey map)

W H A T W E L E A R N E D

Migration Complexities

Can platform-specific data (i.e. permissions, approval) and platform-agnostic data (payees, templates, etc.) be migrated automatically?

Defining Principals

Automation is the ideal, however admin oversight is needed to review any data that might pose risks such as permissions, approval rules, etc.

Different Client Tiers

Three distinct journeys for small business, mid–size, and enterprise clients needed different onboarding experiences based on their services and size.

Different Treatments

It was determined that small and mid–size business clients will be digitally onboarded. While enterprise clients will receive white glove treatment (that’s out of my scope).

Outcomes

The blueprint gave everyone a shared view of the journey, which aligned teams on roles, dependencies, and timing.

Seeing its impact firsthand, stakeholders began advocating for service design as a way to tackle future cross-platform challenges.

The Challenges of Onboarding Experience

Admins receives separate emails for each setup task, each linking to a different, non-intuitive location across platforms, forcing them to self-track progress and repeatedly reorient.

While foreign currency setup relied on offline forms and back-and-forth with relationship managers.

The 🍒 on Top: Constraints That Shaped the Solution

One-time Build

The acquisition flow was a single-use tool, so we had to deliver a clear experience while keeping engineering effort low.

Platform Dependencies

User and permission data flowed from the core banking system into the payments platform, creating strict rules the onboarding experience needed to respect.

No Traceability

Although clients had six tasks to complete, we couldn’t build a connection between our onboarding list and legacy platforms to know if the tasks were completed.

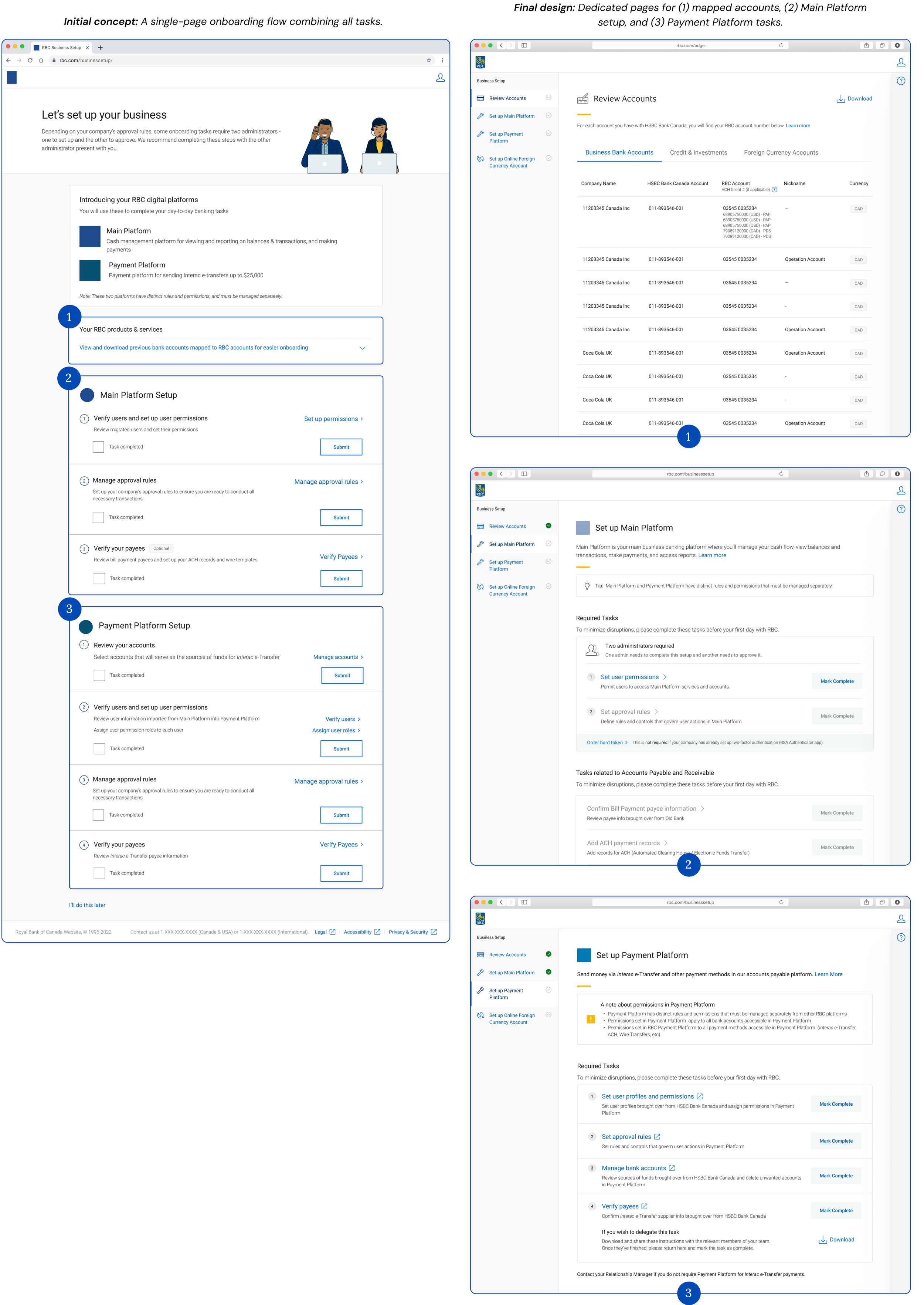

First Attempt: One-Pager

The idea was to bring together all the setup steps for both the main banking platform and the payment platform in one place (the 3rd platform was out of scope), so clients could see their progress at a glance and self-check once they complete the task.

Tasks opened in separate tabs, and admins returned to the page to mark each one as completed.

When Simplicity Wasn’t Enough

As we shared this approach with our GTM and product teams, it became clear that clients would need more pre-disclosure information, context about each platform, more guidance about tasks, and lastly, a third platform setup that needed to be built from scratch

To support the growing complexity of onboarding, we redesigned the experience into a guided, step-by-step flow. Clients now get clarity on what they need to do, when to do it, and why each task matters.

Breaking it down into steps

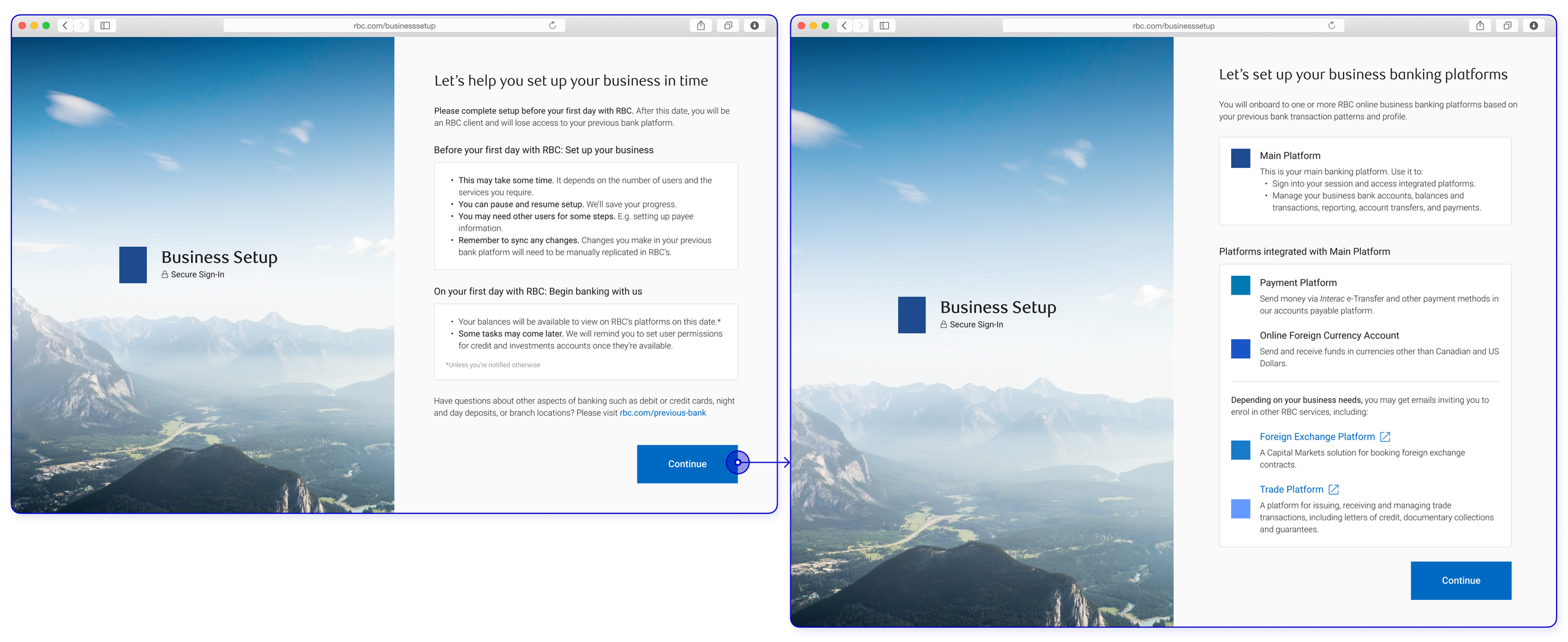

Set Expectations Early

We added introductory pages that explain what to expect before, during, and after setup. Clients learn what each platform is for, and what they need to prepare ahead of migration.

Review Accounts & Set Up Platform Separately

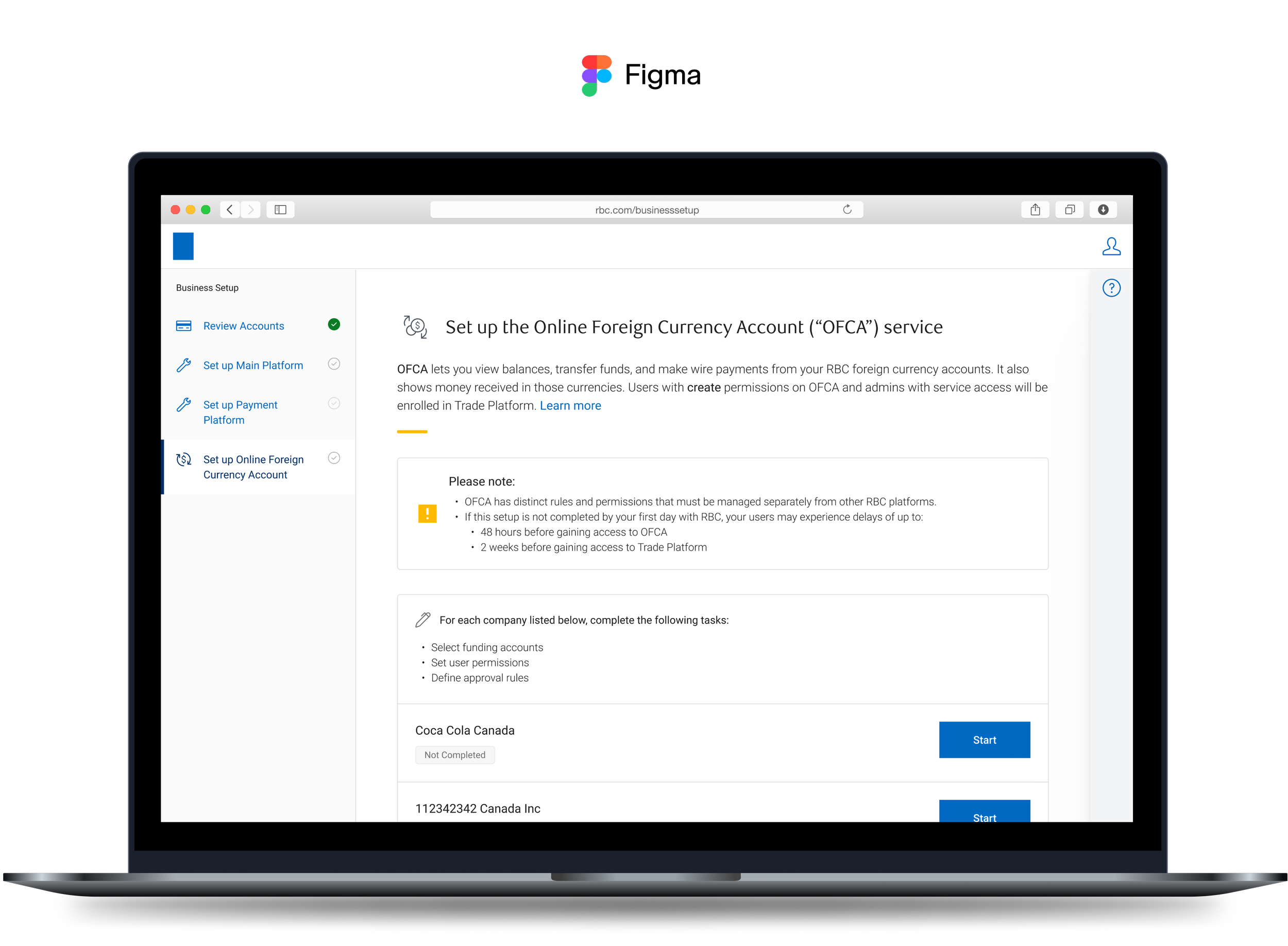

Clients first land on a separate Review Accounts page where they can see hundreds of mapped business, credit, and foreign currency accounts. From there, each platform has its own setup page with required tasks and progressive disclosure so admins know what to prepare and complete for that specific platform.

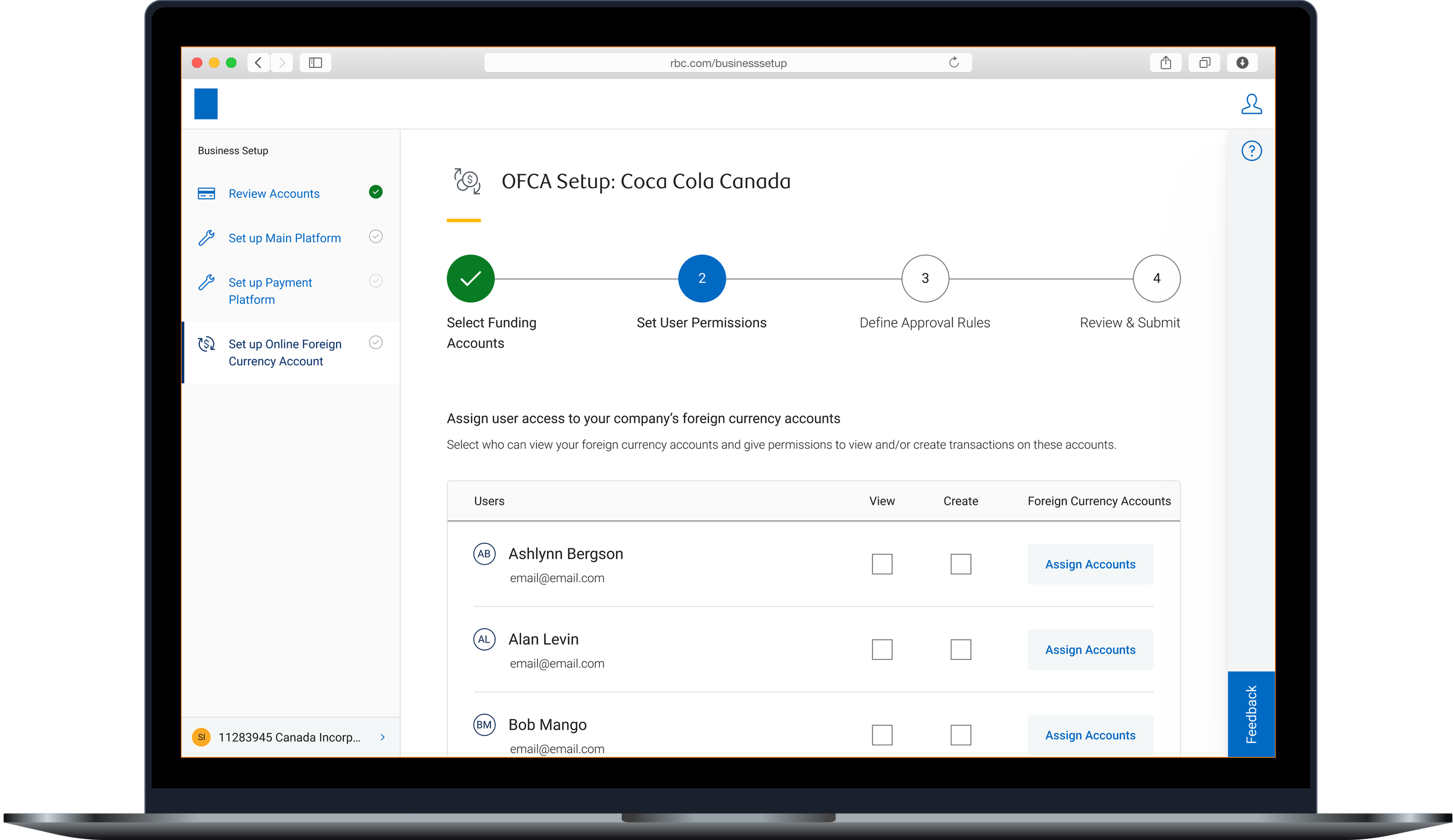

We digitized the paper-based workflow for setting FX permissions and approval rules so clients could transact in their foreign exchange accounts before migration.

This is the final direction, and I happily walk through the full multiple iterations and collaborative process in interviews 😁

Streamlined FX setup

Because we couldn’t test with actual clients due to NDA restrictions, we created scenario-based tests with a proxy group. We learned that users needed clearer explanations about why multiple platforms were involved and what to prepare before each step. This helped us strengthen the content so onboarding was easier to understand.

Testing what we built

Outcomes

Fewer support calls during onboarding

Clear context and in-platform help lowered onboarding questions directed to customer support.

Less reliance on relationship managers for FX setup

The new digital FX permissions flow allowed clients to complete setup independently, reducing the need for manual assistance.

Stakeholder Managment

Using service design artifacts and weekly touchpoints, I aligned expectations, gathered actionable feedback, and clarified requirements to enable iteration that balanced business goals and user needs.

Designing within legacy constraints

Created structure and clarity even when core platform UIs couldn’t change due to technical and timeline limits.

Working with limited user access

Partnered with research to interpret proxy feedback and pressure-test assumptions when client testing was restricted.

Orchestrating multi-platform setup

Turned interdependent steps into a progressive, guided flow anchored to a single source-of-truth platform.

What I’ve Learned

Looking Ahead…

This work revealed that platforms outside our ecosystem will need to be brought into the long-term roadmap.

Unifying them within a single business banking platform will significantly improve client experience and operational efficiency.